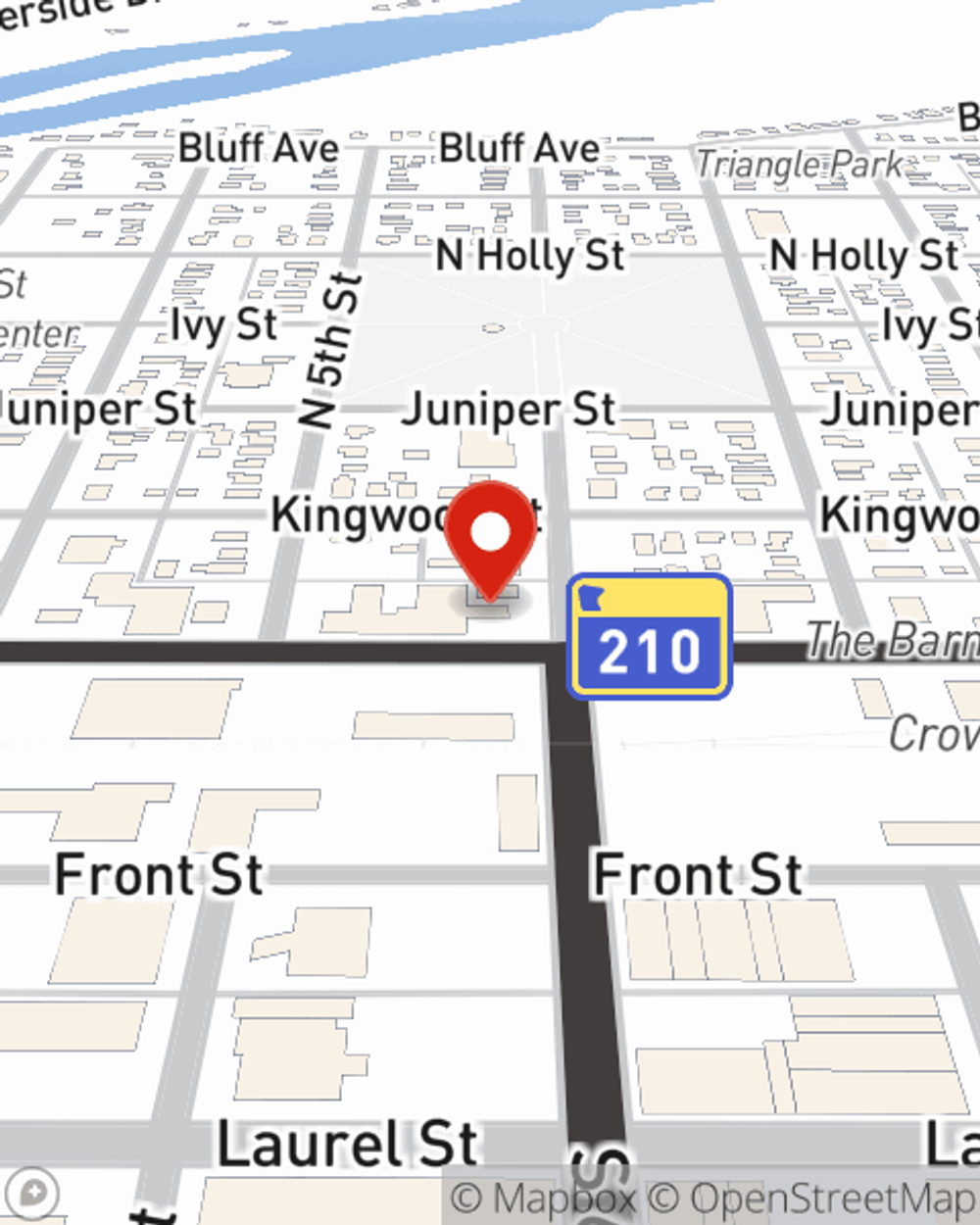

Condo Insurance in and around Brainerd

Brainerd! Look no further for condo insurance

Condo insurance that helps you check all the boxes

Calling All Condo Unitowners!

Because your condo is your home base, there are some key details to consider - size, neighborhood, cosmetic fixes, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you excellent coverage options to help meet your needs.

Brainerd! Look no further for condo insurance

Condo insurance that helps you check all the boxes

Why Condo Owners In Brainerd Choose State Farm

With this coverage from State Farm, you don't have to be afraid of the unpredictable happening to your condo and its contents. Agent Jake Brandt can help lay out all the various options for you to consider, and will assist you in constructing a terrific policy that's right for you.

Finding the right protection for your condo is made easy with State Farm. There is no better time than today to contact agent Jake Brandt and explore more about your outstanding options.

Have More Questions About Condo Unitowners Insurance?

Call Jake at (218) 454-2888 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Jake Brandt

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.